Zimbabwe’s biggest platinum producer, Zimplats holdings’ productions increased by 7 per cent when the miner extracted 7.2 million tonnes of ore 700 thousand more than the 6.7 million tonnes achieved in FY2019 the company’s chairperson of Board Dr Fholisani Sydney Mufamadi has said.

Rudairo Dickson Mapuranga

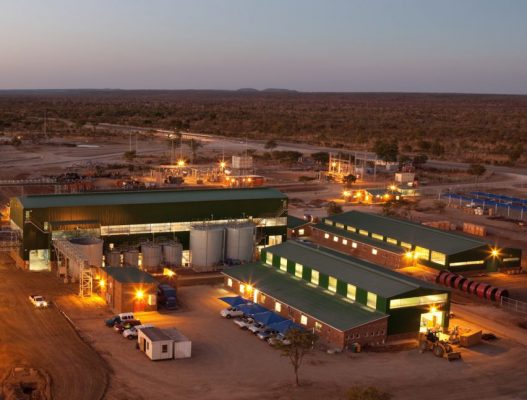

Through his annual message to the company’s stakeholders, Mufamadi also said that milling volumes for the Ngezi based miner increased by 300 thousand tonnes due to the tonnes addition from the company’s Mupani mine and fleet productivity enhancement initiatives.

“Your Company mined 7.2 million tonnes of ore, 7% more than the 6.7 million tonnes achieved in FY2019. Milling volumes also increased from 6.5 million tonnes in FY2019 to 6.8 million tonnes due to ore from Mupani Mine and benefits of fleet productivity enhancement initiatives that started towards the end of FY2019 and have now been rolled out to all the underground mines. The concentrator plants outperformed their previous year throughput due to higher running time and milling rate.”Mufumadi said in the report.

The 6E ounces produced increased marginally to 580 178 ounces from 579 591 ounces achieved in FY2019. The positive impact of the 5% increase in mill volumes on metal production was partly offset by in-furnace inventory build-up on start-up after the 122 days major furnace rebuild shutdown which commenced on 10 June 2019 and was completed in the first half of FY2020.

The Group recorded a profit for the year of US$261.8 million, 81% increase from US$144.9 million achieved in the prior year. This was mainly attributed to the increase in revenue (US$868.9 million in FY2020 compared to US$631 million in FY2019) arising from improved metal prices and decrease in exchange losses from US$20.2 million in FY2019 to US$4.8 million. This was partly offset by the discontinuation of the Reserve Bank of Zimbabwe export incentive scheme in February 2019 resulting in other income decreasing by US$45.8 million compared to the prior year.

The Company paid the final instalment of US$42.5 million on the Revolving Credit Facility with Standard Bank of South Africa. In addition, the Group generated enough cash to pay dividends amounting to US$45 million.

The Mupani Mine development project, (replacement for Rukodzi and Ngwarati mines), progressed well during the year and is on schedule. The project is expected to be completed on time and within the approved budget.

The Bimha Mine redevelopment project is substantially complete save for the underground workshops whose progress was affected by the COVID-19 pandemic. The company expect to commission the workshops in the first half of FY2021.