In an endeavour to improve power supply into its operations, the country’s biggest platinum group metals (PGM) producer ZIMPLATS, has concluded a 50MW power import agreement with the Zambia Electricity Supply Company (ZESCO).

Rudairo Mapuranga

Through an update for the quarter ended June 30, 2023, the PGM producer said works on the 185MW solar plant, which is being installed at a cost of US$201 million remains on schedule.

According to Zimplats the ZESCO direct power import deal which was concluded in the Quarter has an immediate impact on power stability and availability.

For the medium to long term, however, the mining group is currently working on a 185MW solar plant, which will be set up in four phases. A cumulative US$1.1 million had been spent on the first phase of its solar project, a 35MW solar plant at the Selous Metallurgical Complex, and US$35.4 million had been committed, against a budget of US$37 million.

“The first of the project’s four implementation phases is progressing as planned, with the final phase scheduled for completion in FY2027, at a total project cost estimate of US$201 million,” said the group in the update.

The increased power supply contributed to the company’s production output during the period under review, as ore milled increased by 3% from the previous quarter to 1.94 million tonnes due to an increase in operating days and improved power availability.

Mined tonnage increased by 6% from the prior quarter, as the number of operating days increased from 90 in the prior quarter to 92 in the period under review, and trackless mining machinery availability improved, while mined volumes increased by 4% from the prior comparable quarter, which was negatively impacted by poor equipment availability at Mupfuti Mine.

6E head grade increased by 2% from the previous quarter due to improved ore mix but decreased by 4% from the prior comparable quarter due to a higher volume of milled throughput obtained from low-quality stocks.

The combination of enhanced milling, grade, and recovery resulted in a 9% increase in final product volumes of 6E metal. Metal quantities grew by 7% over the previous comparable quarter, as higher milled throughput and a small improvement in process recoveries were offset by a fall in 6E head grade.

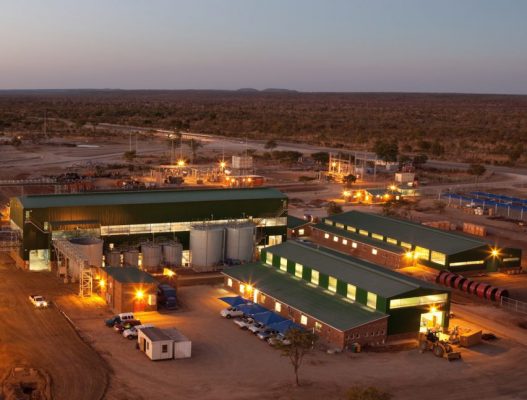

During the period under review, Zimplats, says it has spent U$10.9 million to date on the base metal refinery upgrade project at the Selous Metallurgical Complex in order to further beneficiate converter matte.

This is part of the platinum miner’s overall capital investment strategy, which has a budget of US$1.8 billion to be implemented over a 10-year period beginning in 2021 and has been authorized by the Zimplats board.

“Implementation of the base metal refinery refurbishment project progressed well during the quarter with US$10.9 million spent to date, and a further US$18.4 million committed, against a total budget of US$189.9 million,” Zimplats said.

The projects under the US$1.8 billion strategy include maintaining current production levels through mine replacements and upgrades. The report says that the miner, spent US$318.8 million on the projects to develop Mupani Mine and upgrade Bimha Mine to replace Rukodzi Mine, which was depleted in FY2022, and the Ngwarati and Mupfuti mines, which will be depleted in FY2025 and FY2028, respectively.

The smelter expansion and SO2 abatement plant projects also advanced as planned during the quarter, with US$112.2 million invested to date and an additional US$329.3 million committed.

During the quarter, exploration activities focused primarily on surface diamond drilling to upgrade the Group’s Mineral Resources, geotechnical assessments of rock mass properties, and sample collection for geo-metallurgical test work to support current and future mining operations in Ngezi (ML37).