Zimplats has spent about US$372,8 million in various projects in the country, with the Mupani and Bimha mines development chewing the largest chunk.

According to the company’s quarterly activities report for the period to September 30, 2022, the projects were at different stages of implementation.

The mining giant said the development of Mupani Mine and the upgrading of Bimha Mine had progressed well during the quarter.

A total of US$252,2 million has been spent on the projects to date, the firm said, adding that US$82,4 million had been committed against a project budget of US$468 million.

“The third concentrator plant, which will increase milling capacity by 0,9 million tonnes per year, was commissioned during the quarter. Cumulative project expenditure as at the end of the quarter amounted to US$91,3 million, with US$9,3 million committed against a project budget of US$104,1 million. The plant is expected to ramp up production to design capacity by the end of the second quarter,” the report read in part.

Zimplats said the implementation of the US$521 million smelter expansion and sulphur dioxide (SO2) abatement plant project was on course, with US$28,8 million spent and US$215 million committed as at end of the quarter.

“Implementation of the 35MW solar plant which is Phase 1 of Zimplats’ 185MW solar project progressed during the quarter with US$0,5 million spent against a budget of US$37 million,” it said.

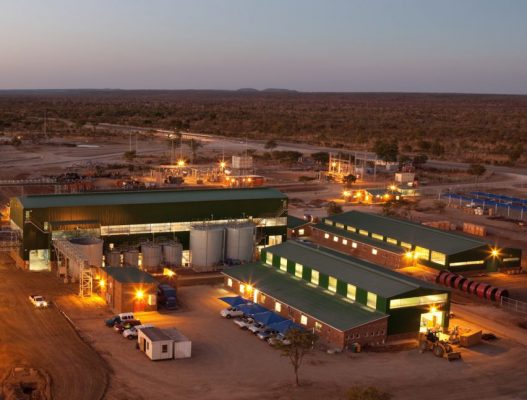

A solar plant is being constructed at Selous Metallurgical Complex and is targeted for completion in 2024. Overall, the project has four implementation phases with the last phase scheduled for completion in financial year 2027 at a total project cost estimate of US$201 million.

Apart from these projects, Zimplats said US$0,4 million was spent on exploration projects, with a further US$1,1 million committed as at September 30, 2022.

Exploration activities included mineral resource evaluation comprising approximately 6 103 metres of surface diamond drilling on mining lease ML36, it said.

In the period under review, mined tonnage increased by 2% quarter-on-quarter and 4% year-on-year following good operational performances across the mines.

Rukodzi Mine, the highest-grade operation in the portfolio, was mined out at the end of the previous quarter. This impacted 6E (ruthenium, rhodium, palladium, osmium, iridium and platinum) head grade, which decreased slightly by 1% to 3,41g per tonne.

“Ore milled decreased by 2% to 1,73 million tonnes from the 1,77 million tonnes milled in the previous quarter mainly due to power outages at the processing plants and a planned mill reline shutdown during the period,” it said.

Zimplats said 6E metal in the final product decreased by 8% from the prior quarter and 3% year-on-year, mainly due to decreased mill volumes, lower head grade and recovery, and the accumulation of inventory following the furnace reline shutdown during the quarter.

Total operating cash costs increased by 5% from the prior quarter, driven mainly by a 2% increase in tonnes mined and inflationary pressures. The company said a total of US$4,3 million was transferred from operating costs as volumes mined during the quarter exceeded the tonnes milled.

“In addition, the quarter closed with stocks of concentrates that will be smelted in the second quarter. This resulted in the cost of metal produced increasing by 2% compared to the previous quarter,” it said.

Zimplats said the 8% decrease in 6E ounces produced and the 2% increase in costs of production resulted in 6E unit costs increasing by 10% to US$801 per ounce. Year-on-year unit costs increased by 18%, mainly due to the inflationary increase in operating cash costs and a 3% decrease in 6E ounces produced.

Newsday