Zisco explains ZimCoke deal cancellation

THE cancellation of the US$225 million deal between Zimbabwe Iron and Steel Company (ZiscoSteel) and ZimCoke was necessitated by the need to maintain the former as an integrated firm and the arrangement was not a “win-win” deal, ZiscoSteel board chair Engineer Martin Manuhwa has said.

The Ziscosteel board terminated a contract with ZimCoke which was supposed to take over the coke ovens within the Ziscosteel plant.

In 2017, both firms entered into an agreement when ZimCoke bought the coke-making assets of Ziscosteel consisting of the plant and machinery, land and buildings as well as associated infrastructure of coal handling and wagons.

However, Government terminated the deal upon recommendation by the previous board led by Professor Gift Mugano which believed the deal was not in “good faith”.

ZimCoke have since sought compensation from the State claiming the deal wasted their time and resources during their three-year stay at the plant.

But during the recent visit by Industry and Commerce Minister Dr Sekai Nzenza to the ZiscoSteel plant, current board chair, Eng Manuhwa said the arrangement was not a winwin.

Industry and Commerce Minister Dr Sekai Nzenza

“We have cancelled the ZimCoke deal as the board and we have advised our ministry, Cabinet and all stakeholders. Agreements of this nature were not on a win-win platform and we wanted to try and maintain ZiscoSteel as an integrated steelmaker, rather than breaking the company into many parts,” said Eng Manuhwa.

ZiscoSteel is expected to sign a three-year contract with their new investor, Kuvimba Mining Holdings that will see the investor investing largely in human capital to strengthen the balance sheet.

The contract, with a sunset clause, is also open for extension of the contract after its lapse depending on the state of affairs by then.

The steelmaker is expected to receive an initial US$300 million capital for immediate resuscitation of the company and Eng Manuhwa said ZimCoke was not part of the revival strategy.

“As professionals on the ground, we want to see smoke in the next 12 or so months and the methodology or proposal by ZimCoke are not part of the strategy hence we have cancelled it.

All the legal elements required have since been undertaken,” he said.

Although appreciating efforts done by previous boards and the potential investors, Eng Manuhwa reiterated that the deal was one sided.

“Because of that reason, we had no option but to cancel the deal. We now need a thorough interrogation and feasibility study of the pathway ZiscoSteel want to take, which is an integrated approach as a steelmaker,” said Eng Manuhwa.

Technical teams from both Kuvimba and ZiscoSteel are already on the ground carrying out feasibility studies that will lead to the purchase of latest technology to augment what is already on the ground before signing of MoU and kick start production.

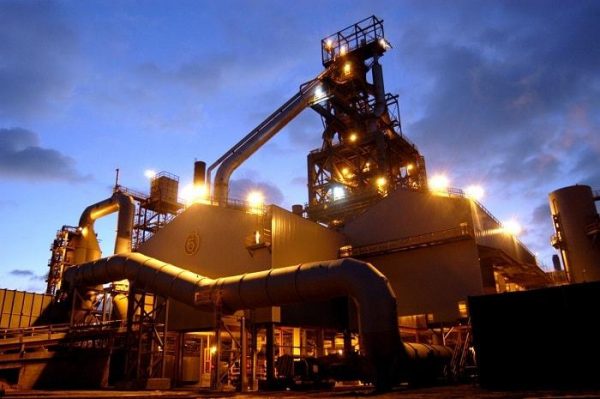

ZiscoSteel, located in Redcliff became defunct after a string of operational problems.

By early 2008, the company was producing less than 12 500 tonnes, way below the breakeven capacity of 25 000 tonnes and was shut down later that same year.

In November 2010, Essar Holdings, the African unit of India’s Essar Global agreed to buy 54 percent in ZiscoSteel in a deal worth $750 million, with the Government keeping 36 percent and 10 percent to be owned by minority investors.

But the deal eventually fell through due to a number of technicalities.