The Zimbabwe Iron and Steel Company board has resolved to terminate the controversial takeover deal of some of the firm’s key assets by ZimCoke, an investment vehicle fronted by businessman Eddie Cross on suspicion the transaction was flawed, Business Weekly can exclusively reveal.

ZimCoke bought Zisco assets related to the production of coke on the understanding that when the steel plant is revived, it will get its coke needs from ZimCoke.

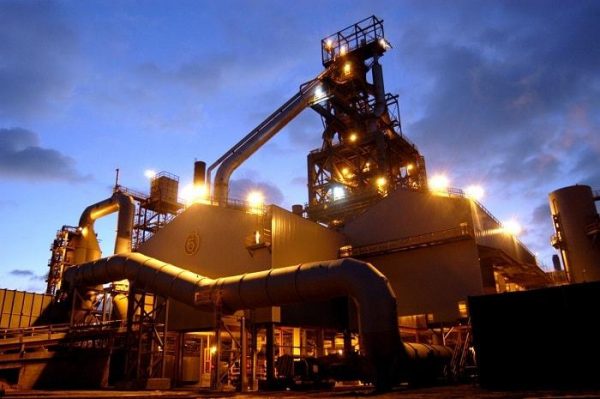

Zisco stopped operations in 2008, plagued by a lack of capital to recapitalise and mismanagement. With its furnaces having the capacity to produce up to one million tonnes of steel per year, the company was among the country’s major foreign currency earners.

According to Cross, the ZimCoke deal, valued at US$225 million was signed in July 2017, when Dr. Mike Bimha was Industry and Commerce Minister. It was given final approval by Cabinet on May 4 this year and the transfer of the assets was signed a month later.

The transaction was a debt/asset swap involving Zisco assets and Zisco steel debt owed to the German bank KfW GMBH in Frankfurt. Cross claims that the Zisco debt was valued, at the time of the transaction, at US$225 million but will exceed US$350 million by the time the debt is expunged by payments from ZimCoke.

Several people with the knowledge of the deal, however, revealed to Business Weekly that the Zisco board resolved to terminate the deal citing serious corporate governance inadequacies since the arrangement was entered into without the knowledge of the former board, led by former CBZ Holdings chief executive Nyasha Makuvise.

However, Makuvise could not be reached on his phone yesterday.

It is also alleged that the legal team at the Ministry of Industry and Commerce was not involved in crafting the contract as “Bimha personally handled the transaction.”

The sources said there was no proper due diligence conducted prior to the sale of the assets, while no professional evaluation was done to ascertain the debt to the Germany bank.

This comes at a time when R&F, the Chinese investor, which was looking at acquiring a shareholding in Zisco recently advised the Government that it was pulling out.

The collapse of the R&F deal became the third after similar transactions involving Indian firms, Global Steel Holdings, and Essar Holdings, failed in 2006 and 2015 respectively.

R&F had agreed to acquire Zisco’s majority shareholding to pave way for resuscitation of its Redcliff-based integrated steelworks plant at a cost of about US$1 billion.

“The governance procedures were flawed as the Zisco board was not involved in this ZimCoke transaction. The board has the fiduciary role to protect the assets of the company and this alone makes the whole transaction flawed,” said one source who requested not to be named because is not authorised to talk to the media.

“After reviewing the deal, the new board established that about 20 key items including the rail tracks, gas cylinders, coke oven battery, and conveyor belts had been taken over.

“Zisco is an integrated plant…it’s a system and stripping it off some of its components is tantamount to incapacitate the company. Coke oven is the most important asset of Zisco so technically, Cross and his guys had literally taken over the company.”

While Cross said there was an undertaking that when the steel plant is revived, Zisco will get its coke needs from ZimCoke, sources said there was no clause in the agreement that ZimCoke will prioritise coke supplies once the steel plant is revived.

Another source said the fact that due process was not done since the board was not involved, it was clear corporate governance procedures were flouted, thus making the deal null and void.

“Economically, Zisco is an integrated steel industry, which cannot do without coking ovens and as such to take over the ovens is as good as incapacitating Zisco,” another source said. “ZimCoke has over and above to the coking oven taken vast assets of Zisco which ranges from railway line, conveyor belt, library, slag, houses which has nothing to do with the coking ovens. This is not an investment but asset stripping.

“It is clear the intention of ZimCoke is beyond operationalising coking ovens but taking over Zisco.”

Zisco acting chairman Dr. Gift Mugano, declined to disclose details on the deal and simply said his board would issue a comprehensive comment at an appropriate time.

“We have a lot of issues that we are dealing with so at this stage it will be premature to comment on the affairs at Zisco. We will do so at the right time.”

However, Cross defended the deal, saying it was the first full privatisation of a State asset under policies adopted by the new administration in line with state enterprises reforms.

“The plant is completely derelict and has not operated for over 12 years,” said Cross. “Zisco itself remains heavily in debt and has also not functioned since 2008. It has no capacity to raise the funds to settle its own obligations or to rebuild the plant.

“The shareholders in ZimCoke are going to invest over US$500 million to get the coke plant back into operating condition. In addition, the company will have to invest in clean water supplies, power generation, railways, and Hwange Colliery.

“None of which are able at present to meet the needs of the plant. When this investment programme is complete, ZimCoke will be the largest industrial exporter from Zimbabwe.”

Cross said the rebuilding of the coke oven plant was the first stage of the long process of resuscitating Zisco. “The plant cannot function without coke and ZimCoke will make the restart of steelmaking that much easier than if the project had not been initiated. Clearly, both companies will have to work closely together to achieve that and the directors are well aware of the obligations,” he said.

Asked what role ZimCoke would have in deciding the investor for Zisco given that the company already owns part of the company’s key assets, Cross said: “No role whatsoever – that is up to the Government of Zimbabwe and the Zisco Steel board of directors. We would, however, ask to be consulted if that was possible.”

Cross said the subdivision of the plant was complete and was awaiting transfer of assets by year-end. This would enable “us to secure financial closure and to start the rebuild.”Business Weekly