R and F, the Chinese investor that was looking at acquiring a stake in the Zimbabwe Iron and Steel Company, has advised Government that it is pulling out of the deal.

Several sources within Government told Business Weekly that efforts to renegotiate the deal, agreed on under the previous administration, were unsuccessful.

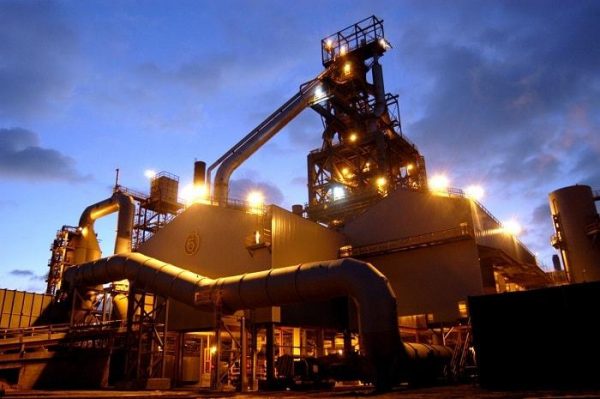

The deal entailed the acquisition of ZISCO’s majority shareholding by R and F to pave way for the resuscitation of its Redcliff-based steel and iron plant at a cost of US$1 billion.

Following the review of the deal under the new dispensation, it came out the transaction had not been negotiated in good faith as it gave the investor “excessive offers”.

According to the sources, the deal was literally as good as mortgaging the country. Other concerns, which were raised by the Government were that R and F was not in steel making business, thus compromising its capacity to revive Zisco, once the largest regional integrated steelworks, from the operational point of view.

Apart from the mineral claims held by Zisco’s subsidiary, some of the assets that had not been factored when the deal was negotiated, include the company’s large real estate and a huge stockpile of scrap metal with an estimated value of US$40 million.

“R and F wrote to the Government advising that it was no longer interested. The parties could not agree after the new dispensation ordered the deal to be re-looked into.

“There are several issues the Government was not happy with.

“It is not like the Government wanted to sideline the investor, but wanted a win-win situation,” said one source.

Industry and Commerce Minister Dr. Sekai Nzenza, who recently took over the ministry following a recent Cabinet reshuffle, said she was yet to be briefed on the situation.

“Zisco . . . will certainly be a priority but I am yet to be fully briefed,” said Minister Nzenza.

Efforts to get a comment from Zisco acting chairperson Dr. Gift Mugano proved fruitless.

ZISCO stopped operations in 2008, plagued by a lack of capital to recapitalise and mismanagement. With its furnaces having the capacity to produce up to one million tonnes of steel per year, the company was among major foreign currency earners.

Foreign investor interest

ZISCO has been a subject of foreign investor interest in the past. Essar Africa Holdings, a unit of India’s Essar Group, had agreed to invest in ZISCO in 2011 during the era of the inclusive Government, but the deal collapsed in 2015. This was after a similar deal with another Indian firm, Global Steel Holdings failed to materialise in 2007.

Essar planned to build a new steelworks complex, replacing the antiquated plant and exported it via a terminal it wanted to build in the port of Beira, Mozambique.

The company was also looking into the feasibility of building iron ore and coal terminals at the port of Beira. There other international companies that once showed interest in Zisco include ArcelorMittal South Africa, a unit of the world’s biggest steel maker.

Former ministers to superintend over failed Zisco deals include Dr. Obert Mpofu in 2006 when the company was negotiating with Global Steel; Professor Welshman Ncube (Essar) during the inclusive Government between 2009 and 2013 during talks with Essar.

The deal collapsed when Dr. Mike Bimha was the Industry minister, leading to signing the deal between Zisco and R and F, which was renegotiated under Nqobizitha Ndlovu, recently reassigned as the Minister of Tourism and Hospitality Industry.

In 2018, Ndlovu told a business conference in Bulawayo that the Government was not satisfied with the progress, saying “we could open up for more interested investors.”

Last year, the Government took over both the external and domestic debt of Zisco of nearly $500 million as it sought to clear its balance sheet and attract investment.

Ziscosteel owed US$212 million in external loans, US$6 millio9 to external suppliers, $57 696 085 in domestic loans and $219 113 219 to domestic suppliers_Business Weekly