Lithium outlook ‘bright as ever’ – report

Over the next ten years, the outlook for the lithium sector is “as bright as ever” amid fast production and demand growth, a new report from Fitch Solutions and Country Risk shows.

However, the constant technological advancements on both the supply and demand sides pose risks to the market outlook. Fitch cautions that since lithium is now considered a ‘strategic mineral’, it will likely lead to rising government intervention in its production and sourcing.

“THE LITHIUM SUPPLY LANDSCAPE WILL EVOLVE QUICKLY AND DRAMATICALLY OVER THE NEXT FEW YEARS”

Fitch

The lithium supply landscape will, therefore, evolve quickly and dramatically over the next few years.

Fitch forecasts global lithium production will more than triple from 442,000 tonnes of lithium carbonate-equivalent (LCE) in 2020 to 1.5 million tonnes of LCE by 2030.

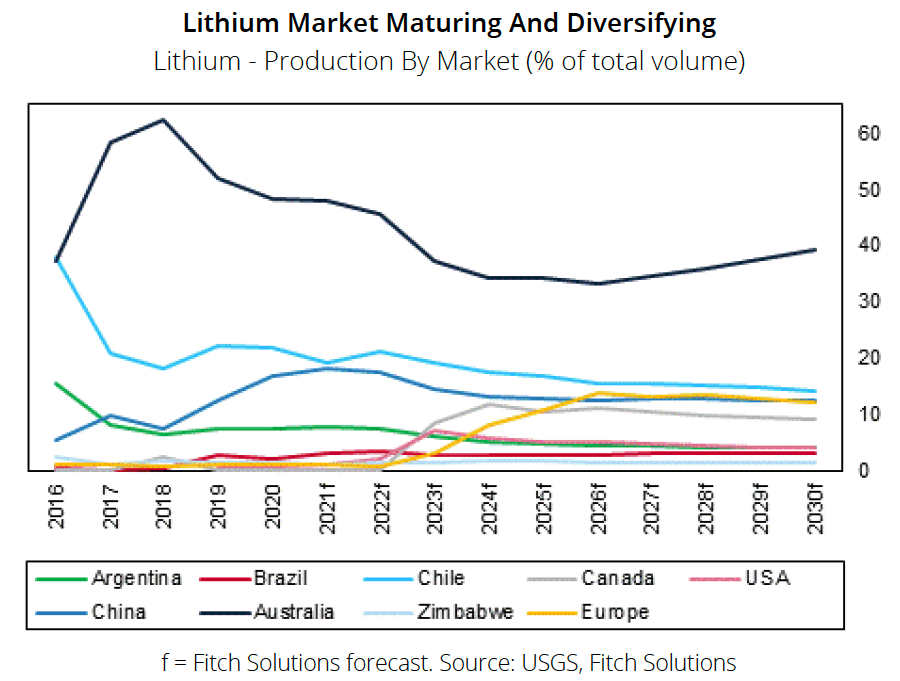

Well-established producing countries will record further growth, while several new lithium-producing markets will emerge in the next ten years. Production growth is expected to accelerate in Australia, which Fitch forecasts will remain the largest lithium-producing country through 2030, given an expected trebling of output over the 2020 to 2030 period.

Production in Chile and China will also more than double, while Brazil output is expected to grow five-fold. Argentina output will double over this timeframe.

The impending boom in energy storage, of which rechargeable batteries are the dominant aspect driven by the electric vehicle (EV) revolution, will be the growth engine behind the lithium upstream sector, Fitch says.

First price forecast

Fitch has, for the first time, also launched lithium carbonate and hydroxide price forecasts. It expects a sharp acceleration in demand for lithium-ion batteries will outpace supply growth, keeping prices elevated.

Fitch forecasts Chinese lithium carbonate 99.5% prices to average $13,450 per tonne this year and at $15,025 per tonne in 2022, and Chinese lithium hydroxide monohydrate 56.5% prices to average $11,950 per tonne in 2021 and $14,300 per tonne in 2022.

Risks to the price outlook include a faster-than anticipated adoption of EVs (upside risk to prices), a faster-than-anticipated advancement of new lithium extraction technologies (downside risk), and a faster-than-anticipated advancement of battery-recycling technology (downside risk).

Fitch forecasts EV sales to drive lithium consumption growth by as much as seven times over 2020 through 2030, while yearly EV sales will grow from 3.1 million to 21.2 million units.

Fitch forecasts the EV sector will account for about 80% of total lithium demand by 2030, compared with between 40% and 45% currently.

China is expected to remain the largest battery manufacturer by a wide margin, for the time being, accounting for about 80% of installed manufacturing capacity as of 2020. However, other existing manufacturers including Japan, South Korea, the US and Hungary will most likely record a rise in battery manufacturing, Fitch says.

Relatively new entrants, including Germany, Poland, Sweden, France, the UK, Thailand and Indonesia, will also establish themselves as increasingly essential manufacturers.

Green premium

The rapid rise of a green premium for lithium amid heightened demand for more environment-friendly resources from downstream players is another critical price trend Fitch is monitoring. Another of the analyst’s recent reports considered how lithium extraction techniques are increasingly under ESG scrutiny.

Currently, only hard rock and conventional brine resources from salars are used to produce lithium at a commercial scale; Fitch estimates about 65% of global output comes from hard-rock lithium mines such as those in Australia, while 35% come from brines in Latin America and China.

A SLEW OF NEW MARKET ENTRANTS ARE WORKING ON NEW EXTRACTION TECHNIQUES WHICH COULD UPEND PRIMARY SUPPLIES OF LITHIUM.

However, a slew of new market entrants are working on new extraction techniques such as geothermal brines and sedimentary (clay) deposits, which could upend primary supplies of lithium.

As the development of these new extraction techniques progresses, the industry structure, the shape of the cost curves, and the environmental, social and governance (ESG) considerations will continue to evolve. Providers of more environmentally friendly lithium with lower water usage and carbon emissions will most likely be rewarded.

Rising demand for the most sustainable lithium, coupled with tight supply, means that over-the-counter transactions, offtake agreements and long-term strategic supply partnerships are here to stay in the coming years.

Technological advancements, meanwhile, are at different stages of development, which Fitch flags could cause supply to rise faster than expected.

These developments will keep the lithium market opaque to some extent, according to Fitch, and lithium will remain more of a speciality chemical market, characterised by clients requiring specific and often differentiated products and less of a bulk commodity market.

The upcoming development of lithium recycling could also ease some of the lithium supply issues in the longer term.

Further, Fitch notes that the lithium content of the promising next generation of batteries is even higher than the batteries that will be dominating over 2021 to 2025.

Mining.com