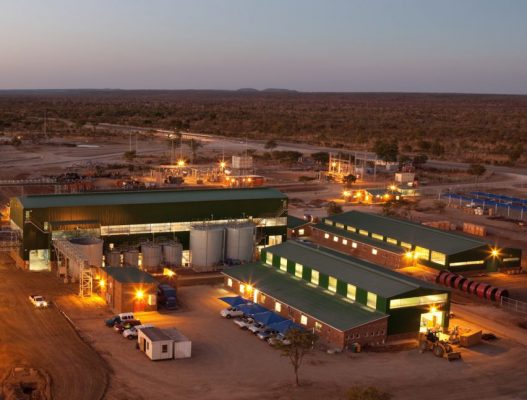

The country’s biggest platinum group metal (PGM) producer, Zimplats, has spent US$858 million on its major projects as of June 30, 2024, according to the company’s quarterly report for the period ending June 30, 2024.

By Rudairo Mapuranga

According to the report, Zimplats spent the money on the Bimha and Mupani mine development and upgrade, smelter expansion, solar plant, and base metal refinery refurbishment, against a budget of US$1.239 billion.

“The Bimha and Mupani mine development and upgrade projects will replace production from the Rukodzi and Ngwarati mines, which were depleted in FY2022 and June 2024, respectively, and Mupfuti Mine, which will be depleted in FY2028.

“Cumulatively, US$407 million has been spent on these projects as of June 30, 2024, against a total project budget of US$468 million.

“A total of US$387 million has been spent on the smelter expansion and SO2 abatement plant project, against a total project budget of US$544 million.

“US$36 million has been spent on the implementation of the 35MW solar plant project, against a budget of US$37 million. The solar plant will be commissioned in the first quarter of FY2025.

“A total of US$28 million has been spent on the Base Metal Refinery refurbishment project, against a total budget of US$190 million,” the Zimplats report reads in part.

Under its US$1.8 billion capital expenditure investment, which was launched in 2021, Zimplats’s strategy involves the setting up of integrated projects, including the development of new mines, expansion of the smelter, construction of an additional concentrator, base metal refinery, sulphuric acid plant, and the establishment of a 110-megawatt (MW) solar power plant.

The report also states that mining volumes increased by 2% year-on-year, benefiting from pillar reclamation activities at Rukodzi Mine and the continued production ramp-up at Mupani Mine, which is under development. However, mining volumes declined by 1% from the prior quarter due to higher productivity at Ngwarati Mine’s primary operations ramping down.

The 6E head grade declined by 1% year-on-year and quarter-on-quarter due to an increased contribution of lower-grade Mupani Mine development ore and dilution from mining across geological structures.

According to Zimplats, year-on-year milled volumes improved by 3% due to the higher milling rates achieved, in line with improved mining volumes. Milled volumes decreased by 1% from the prior quarter, however, due to a planned mill reline shutdown at the Selous Metallurgical Complex (SMC) concentrator. Concentrator recoveries were 1% lower year-on-year and quarter-on-quarter due to lower mill feed grades achieved.

The country’s biggest PGM producer said that as a result of the milled volumes and mill feed grade achieved, 6E concentrate production was the same year-on-year and decreased by 3% quarter-on-quarter.

The group said 6E metal in the final product decreased by 4% year-on-year and 5% from the prior quarter.

.png)