Iron ore price drops sharply on weak Chinese demand concerns

Iron ore prices tumbled on Monday, dragged down by concerns over weak demand for the steelmaking ingredients, as markets eyed the possibility of further production cuts in the top steel-producing city of Tangshan.

China’s top steelmaking city said it will punish firms that either have not taken the steps spelled out under its emergency anti-pollution plan or have illegally discharged pollutants, following weeks of smog in northern China.

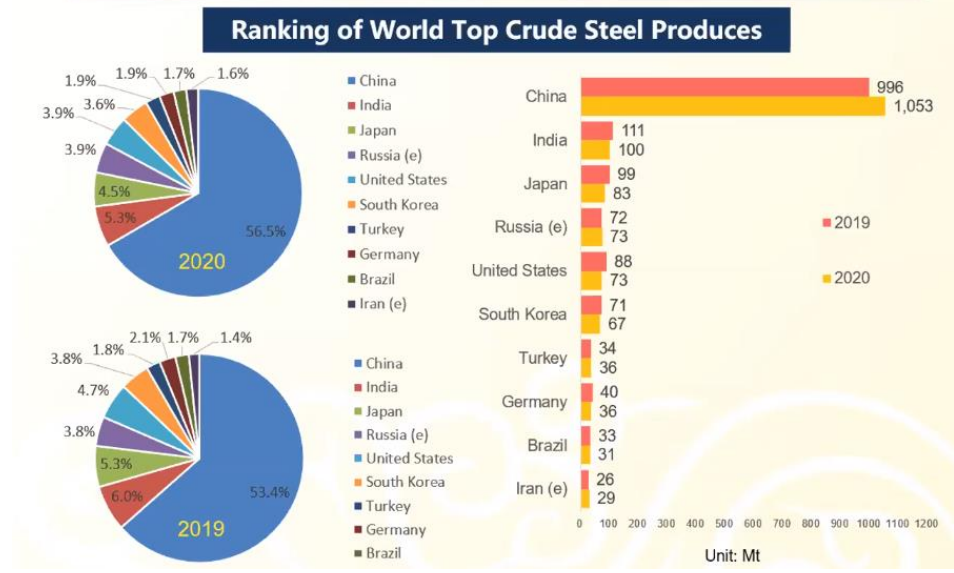

The country, which accounts for more than half of the world’s steel output, has also shut down numerous small and low-quality iron ore mines and will continue to raise its bar on ore quality to match its environmental standards.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were changing hands for $157.01 a tonne, down 4.38% from the previous trade.

The most-traded May iron ore contract on China’s Dalian Commodity Exchange ended the daytime session 5.9% lower at 1,004.50 yuan ($154.35) a tonne.

On the Singapore Exchange, the front-month April contract was down 2% at $151.10/tonne by 0718 GMT.

Dalian coke tumbled 7.3% to 2,131 yuan per tonne while Dalian coking coal shed 3.9% to 1,547.50 yuan per tonne.

Iron ore price reached its highest level since September 2011 in mid-January, but has since declined 9.7%

“We think the next three years could be marked as ‘Supply-side reform 2.0’, during which time we should see accelerating policy changes limit production growth in the industry – this time due to tightening environmental regulations,” analysts at JP Morgan wrote in a note to Reuters.

“The spectre of further restrictions on the real estate market (is) also weighing on sentiment,” ANZ commodity strategists said.

ANZ cited a 7.6% year-on-year growth in property investment in China in January-February, coinciding with “an increased focus on containing asset price bubbles.”

Mining.com