Pensions hope for former Ziscosteel workers

For 62-year-old, Mr David Nhambinda, life has not been what he had hoped to experience on retirement after working for one of the biggest steel producers on the continent.

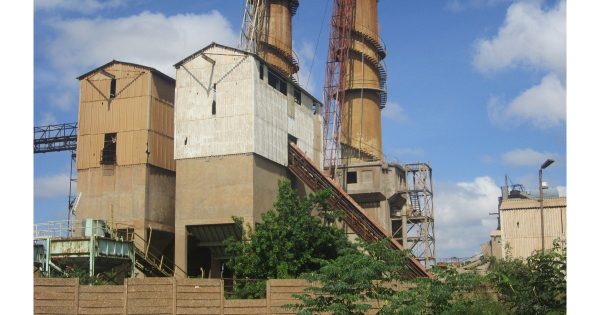

When he joined the now defunct, Zimbabwe Iron and Steel Company (Zisco), the company was the pride of Africa as it boasted of supplying almost every inch of steel in the region.

Working for such a company, Mr Nhambinda hoped that after retiring, he would enjoy his life as he watched his children and possibly grandchildren grow.

Life has however, turned for the worst for the pensioner who can hardly make ends meet.

Mr Nhambinda, together with his six children and wife, stay under squalid conditions in the dusty suburb of Torwood, Redcliff.

He is struggling to make ends meet and is relying on well-wishers and some of his children who are doing menial jobs as most of them failed to complete their education.

Operations at Ziscosteel suddenly took a tumble and things changed before the company closed down operations in 2008 at the height of hyperinflation.

The operational challenges resulted in the company failing to pay its workers as well as remit pensions.

Mr Nhambinda represents about 2 000 or so former Zisco workers who are wallowing in poverty due to the company’s demise.

Ziscosteel became incapacitated to remit both company and individual pensions contributions, leaving the retired workers in abject poverty.

In 2017, Government took over the Zisco debt and managed to pay former workers all their outstanding salaries.

Government also negotiated and made arrangements with the Zimbabwe Revenue Authority and local authorities that were owed by the steel manufacturing firm but the issue of pensioners could not be resolved.

The company which used to employ more than 5 000 workers during its peak in the late 1990s, is now defunct and has failed to pay pensions.

While some blame the demise of the company to mismanagement, some also blame it on the economic failures.

Zisco acting board chairman, Engineer Martin Manuhwa said the issue was giving him sleepless nights.

“The matter really concerns my board that some of our gallant former employees are facing serious difficulties.

“We are, however, in talks with relevant authorities so that the issue is resolved,” he said without shedding more light.

The Insurance and Pensions Commission (Ipec), recently gave the former workers a ray of hope, stating that they might start receiving their pensions anytime soon.

“Kindly note that the commission approved dissolution of Zisco pension fund since the fund was considered to be in an unsound financial condition.

“The advert that you referred to was published in compliance with Circular 10 of 2019, which governs the process of dissolving a fund. The call was for former workers to approach First Mutual and inspect a schedule that shows the amounts that are due and payable to them,” said Ipec pensions manager Ms Tariro Mateisanwa.

She said the authorities were in the final stages of valuation.

“Please note that payment of benefits is yet to commence as the fund is in the process of finalising its actuarial valuation.

“Once the valuation is finalised and submitted to Ipec, for assessment and approval, the fund will start paying benefits to members,” she said.

This comes as Ipec says about 50 000 pensioners could be wallowing in abject poverty while their unclaimed benefits amounting to $30 million lie idle at the pension benefit fund.

The country’s insurance and pensions’ regulator said this was largely due to financial illiteracy and lack of information by the pensioners.

The unclaimed benefits could be subjecting the aged to unwarranted poverty, a move that goes against the regulator’s mandate of enhancing economic wellbeing among the elderly and their dependents.

Labour expert Mr Japhet Moyo said there was need to formulate structures that monitor and make follow ups on such issues that are common across the country.

“This is a national issue and we need a holistic approach to tackle the problem. We have so many workers that are working for years but dying paupers.

“We might have the law but no one is there on policing and ensure that it is followed,” he said.

Going forward, Mr Moyo said Parliament should make follow-ups of such issues.

“For example, the Smith Commission was tasked to investigate how some moneys were rendered useless following inflation but no one bothered to look at the recommendations and the findings and let alone act on those recommendations,” he said.

The Chronicle