The mining industry across Africa is evolving rapidly, driven by the growing demand for smart mining solutions and technological advancements. However, a significant challenge remains: the shortage of adequately skilled human capital to manage and implement these technological systems, Mining Zimbabwe reports.

By Rudairo Mapuranga

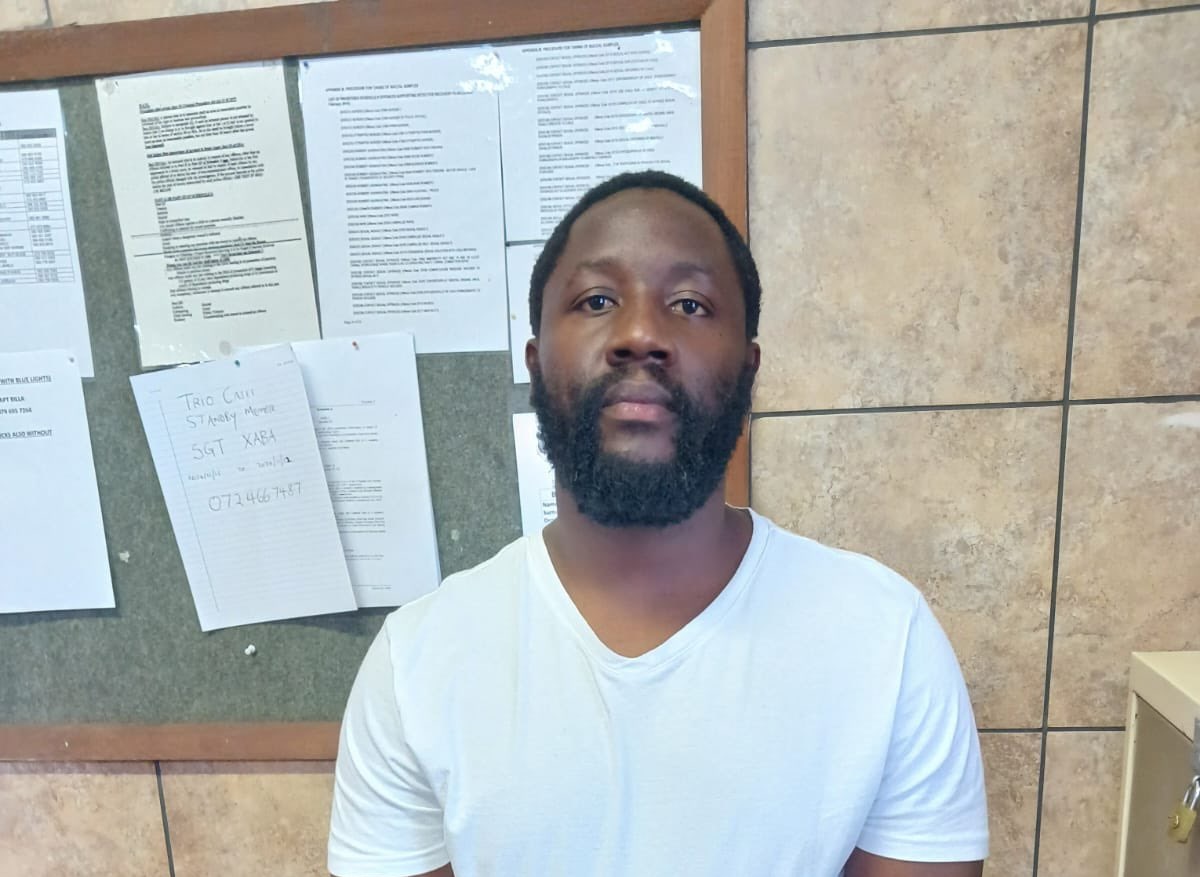

Speaking at the recent Association of Mine Managers of Zimbabwe (AMMZ) Annual General Meeting, industry leaders emphasized the need for a long-term strategy to develop human resources capable of advancing mining operations in the future. Ian Chauke, from Anglo-American’s Amandelbult Complex in South Africa, highlighted the urgency of investing in human capital to support technological growth in the sector.

Chauke identified the primary barrier to smart mining as not just the availability of technology but the lack of skilled personnel to operate and maintain it. He pointed out that across Africa, including Zimbabwe, the shortage of mining engineers with expertise in implementing advanced technologies remains a pressing issue.

“Even though this is a barrier to achieving the smart mining and technology we aspire to, it also presents an opportunity,” Chauke said.

Brain Drain and the Skills Gap

The issue is exacerbated by financial hardships and limited local opportunities, which push many students from Zimbabwe and similar regions to seek education abroad. Many do not return, perpetuating a cycle of brain drain and leaving a skills gap in local mining industries.

Chauke emphasized the need for a long-term approach to human capital development. He called on mining companies to establish stronger partnerships with universities and educational institutions, enabling students to gain practical training and exposure to industry technologies.

“Mining companies must engage with universities. While there are efforts to support students, there is no formalized structure for these collaborations,” he said.

One example of an effective partnership, highlighted by Dr. Beny Chisonga from DataMine, is their provision of free software access to students at Midlands State University in Zimbabwe. However, Chisonga noted that this is only part of the solution. Mining companies must also invest in hands-on training, such as mine planning, to prepare students for real-world applications.

Zimbabwe’s Unique Opportunity

Chisonga also highlighted Zimbabwe’s unique position, where local stakeholders are heavily involved in decision-making for mines. In many other African countries, key decisions are often made by foreign investors. This local control gives Zimbabwe the flexibility and incentive to invest in its youth and ensure future generations possess the skills required to drive the mining industry forward.

Commenting on Chisonga’s remarks, Chauke urged the mining sector to prioritize long-term human capital development over short-term fixes.

Addressing Educational Gaps

The discussions at the AMMZ AGM also raised concerns about the alignment of scholarships with industry needs.

“We are seeing students being awarded scholarships by mines, but they lack the correct subject combinations for mining studies,” said Mrs. Rejoice Moyo, Chairperson at Midlands State University. This underscores the importance of aligning educational programs with the sector’s requirements.

To address this, participants emphasized the need for partnerships between academic institutions and mining companies to focus on curriculum enhancement and the integration of smart mining concepts into education frameworks. Mining companies were encouraged to actively collaborate with institutions to ensure graduates are equipped with the skills needed for the modern mining environment.

Industry-Academia Partnerships

A key challenge identified by Zimbabwe Institute of Rock Engineering (ZINIRE) Vice President Omberai Mandingaisa is the academic system’s lack of practical application. Lecturers often enter academia directly after completing their studies, with little or no industry experience. This disconnect can hinder the training of future mining professionals.

Wits University’s Head of the School of Mining Engineering, Professor Musingwini, proposed secondment programs as a solution. These would enable academic staff to gain practical experience in the mining industry. To retain these professionals, the industry must also contribute to their remuneration to prevent a brain drain from academia to industry.