UK company completes reverse takeover of Zimbabwe coal project

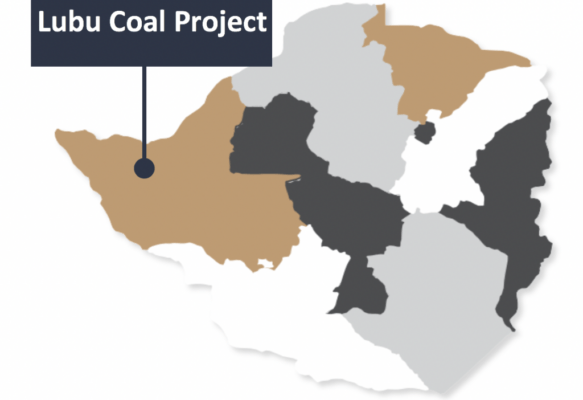

UK Investment holding company Contango Holdings completed acquisition by way of reverse takeover of Consolidation Growth Holdings’ interest in the Lubu coalfield project, in Zimbabwe.

The Company on June 18 started trading on the LSE. The company’s share capital consists of 203-million shares of 1p each.

The admission follows the completion of an acquisition by way of reverse takeover of Consolidation Growth Holdings’ interest in the Lubu coalfield project, in Zimbabwe.

Contango now has a 70% interest in the Lubu project, which has had more than 12 000 m of drilling completed and which has a total resource of more than one-billion tonnes of coal.

The company acquired the interest in the asset for an implied value of £6.4-million and in June last year started an exploration work programme, which included nine drill holes designed to enable full washability test work and the determination of product range and grade.

Contango has spent more than $750 000 on development work at the project to date.

The company is targeting the production and sale of semi-soft coking coal for export to Southern African countries and additional potential for sales of thermal coal to domestic power companies.

Contango is in discussions with a number of offtake groups to sell an initial one-million tonnes a year of coal.

The company says site preparation is under way and boxcut for mining will start soon, with first production and sales expected before the end of the year.

“I am delighted to have successfully brought this asset to market and I am confident that the work conducted on Lubu in recent years will translate to material value for shareholders in the near future.

“The remaining months of 2020 are set to be punctuated with high impact news flow as we look to deliver first production and revenues from Lubu by the end of the fourth quarter,” says executive director Carl Esprey.

He adds that the company’s strategy is centred on providing early cash flows from this first asset, and then expanding its production schedules to realise the full value of this one-billion-tonne coal project.

“I believe this is a message which will resonate with investors as we look to underpin the company’s financial performance with the objective of supporting a dividend policy,” Esprey states.

The company will provide further details on its activities as they progress. The site is being prepared for production, specifically the refurbishment and development of supporting facilities, ground clearance and removal of an overburden of the 20-acre area that comprises the initial mining zone within Block B2 of Lubu.