The African Continental Free Trade Area (AfCFTA) offers a substantial opportunity to boost Zimbabwe’s mining sector. However, its success depends on effective policy enforcement, harmonized regulations, and the collective commitment of all stakeholders, according to a leading global business law firm.

By Ryan Chigoche

Research from the United Nations Economic Commission for Africa (UNECA) shows that the AfCFTA currently serves a market of 1.2 billion people, projected to grow to 2.5 billion by 2050, with a combined GDP of USD 2.5 trillion. UNECA estimates that intra-African trade could increase by 15% to 25% by 2040 due to the agreement.

For Zimbabwe, this presents a unique opportunity to enhance intra-African trade, drive economic growth, and promote sustainable development through its mining sector. With its vast geological resources, Zimbabwe enjoys a competitive edge in mining, positioning the country to benefit significantly from the AfCFTA. The agreement also aligns with Zimbabwe’s ambitious goal of generating USD 12 billion annually from its mining industry by 2030.

Zimbabwe’s Potential Under the AfCFTA

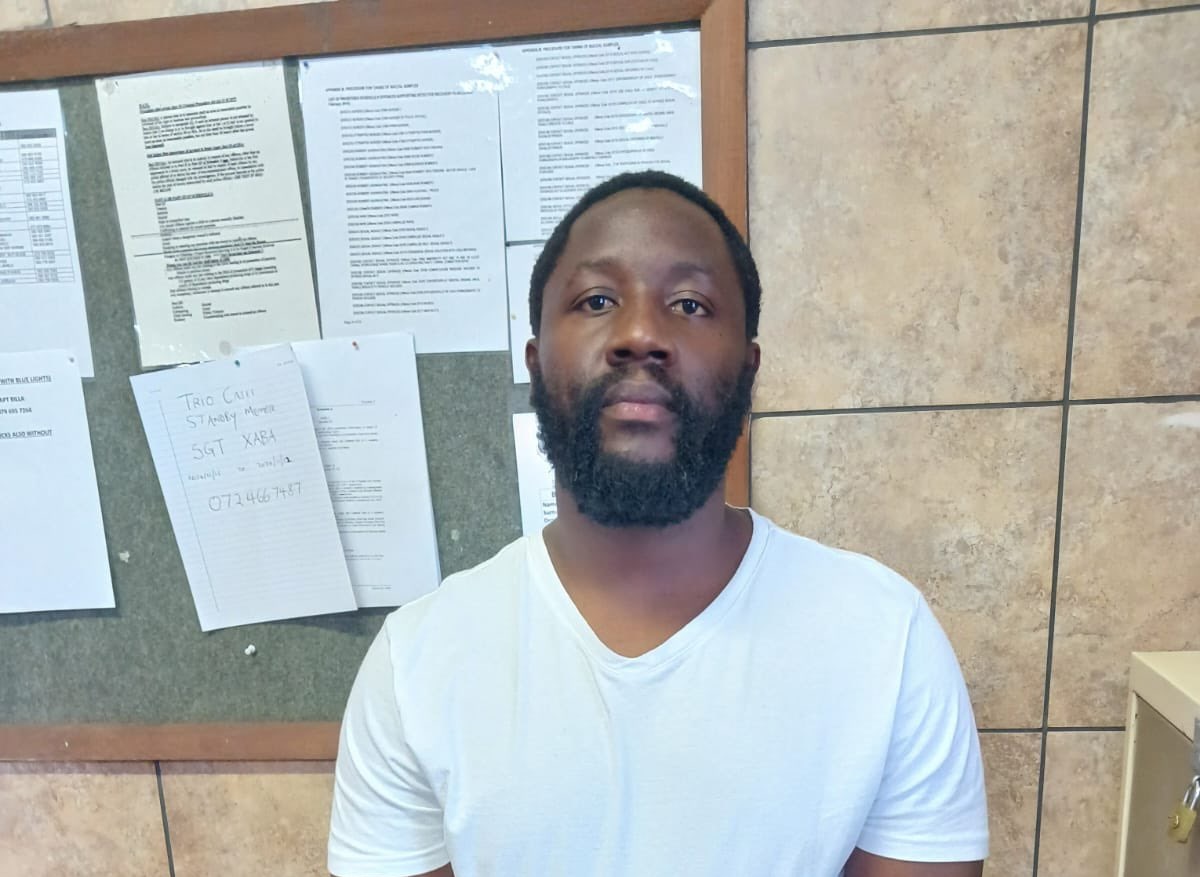

Tinashe Famba, a business attorney at DLA Piper Africa, highlighted the opportunities the AfCFTA brings to Zimbabwe’s mining sector.

“Zimbabwe has the second-largest platinum and chrome deposits and the fifth-largest lithium deposits in the world, making it an attractive investment destination. The dismantling of trade barriers through the AfCFTA will likely lead to increased investment in the mining sector. AfCFTA’s efforts to harmonize regulations offer a major opportunity for mining hubs like Zimbabwe by streamlining licensing and permitting processes, thus enhancing the ease of doing business,” said Famba.

He further emphasized, “The AfCFTA, with its unified set of rules, standards, and protocols designed to facilitate trade and investment, marks a significant step toward regional integration in Africa. For the mining industry, it encourages collaborative agreements among stakeholders to facilitate the trade of mineral resources. The agreement’s focus on intra-African trade and integrated supply chains is a considerable advantage for Zimbabwe.”

Moving Beyond Raw Material Extraction

To improve its competitiveness under the AfCFTA, Zimbabwe should adopt a cohesive national strategy for continental and regional integration. This includes refining trade facilitation processes, strengthening policies, and improving legal and regulatory frameworks.

One of the AfCFTA’s key goals is to promote industrialization across Africa, aligning with Zimbabwe’s long-term economic strategy. By opening markets and attracting manufacturing investment, the agreement could help Zimbabwe transition from exporting raw minerals, such as platinum, lithium, and chrome, to developing smelting and refining industries that produce higher-value products.

This process, known as beneficiation, would significantly increase the revenue generated from Zimbabwe’s mineral wealth while creating jobs in value-added industries. It would also help diversify Zimbabwe’s economy, which has historically relied heavily on agriculture and mineral exports.

AfCFTA’s focus on regional economic integration could facilitate the establishment of industrial clusters where raw materials are processed into finished goods. These clusters would not only benefit Zimbabwe but also its neighbours, creating a more integrated and competitive regional economy.

Streamlining Trade

The AfCFTA fosters deeper economic ties by simplifying customs procedures, reducing tariffs, and removing trade barriers. This will enable Zimbabwean mining companies to access regional markets more easily, boosting demand for Zimbabwe’s mining products and encouraging operational efficiency and innovation.

Historical trade agreements such as the North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA), demonstrate the benefits of free trade. These agreements streamlined regulations and reduced tariffs on mineral exports, fostering trade and investment in the mining sectors of the U.S., Canada, and Mexico.

Zimbabwe’s Strategic Position

The AfCFTA is a powerful tool for economic transformation, and Zimbabwe is strategically positioned to capitalize on this new era of trade and regional integration. The country’s abundant mineral resources, combined with AfCFTA’s ability to unlock new markets, streamline regulations, and reduce trade barriers, create an unparalleled growth opportunity for the mining sector.

However, to fully realize the benefits of the AfCFTA, Zimbabwe must address challenges such as policy alignment, infrastructure development, and regulatory harmonization. By adopting a forward-thinking approach and collaborating with regional stakeholders, Zimbabwe can establish itself as a leading mining hub in Africa, attracting investment, driving industrialization, and contributing to sustainable economic growth locally and continent-wide.

Conclusion

The AfCFTA is more than a trade agreement; it is a pathway to economic transformation, industrialization, and regional cooperation. By embracing the opportunities it presents, Zimbabwe can position its mining sector for long-term success in African and global markets.